tax loss harvesting limit

But you could sell off your investments at any time. Investors often harvest their investment losses near the end of the year.

Calculating The True Benefits Of Tax Loss Harvesting Tlh

This means that the.

. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. In the 24 tax bracket that would come out to 024 4000 960 paid in short term capital gains and 015 4000 600 in long term capital gains. Suppose you bought 2 Bitcoins for 5000 and 5 Ethereum for 9000 in 2019.

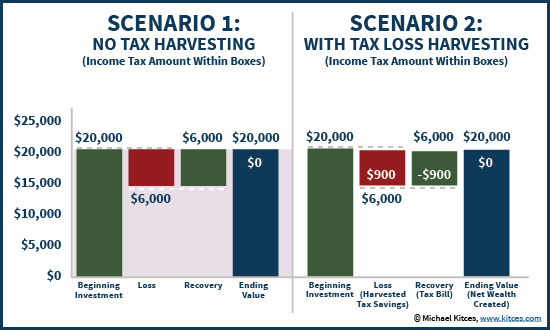

Your 25000 loss would offset the full 20000 gain from Investment A meaning youd owe no taxes on the gain and you could use the remaining 5000 loss to offset 3000. Is there a limit to tax-loss harvesting. However there are limits to the amount of taxes on ordinary income that can be.

Even better if your capital losses are more than your gains you get a bonus. Assess your current gainslosses. Heres what you need to keep in mind before you execute a tax loss harvesting strategy.

The beauty of tax-loss harvesting is that you can use capital losses to offset all your capital gains. And Mary would use the proceeds from the sale to purchase another fund to serve as a. So if you have a 4000 gain and a 1000 loss youd.

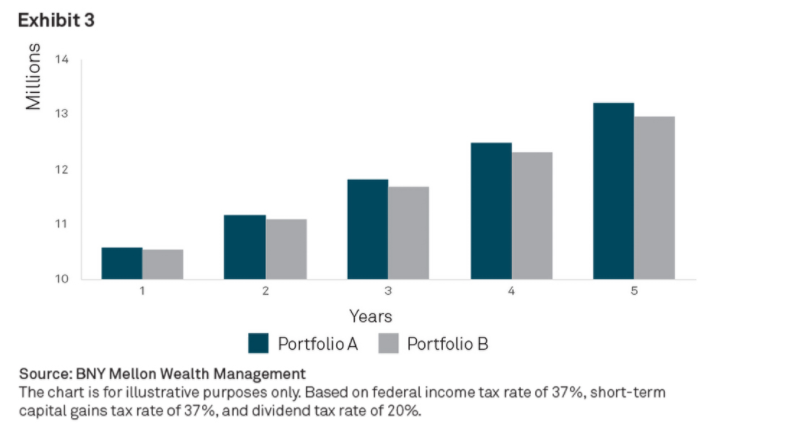

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. And for those with larger amounts of capital Schwabs tax-loss harvesting kicks in for clients who have invested assets of 50000 or more. This illustrates that tax loss.

There is a 3000 limit on the amount of capital gains losses that a federal taxpayer can deduct in a single tax year. Some tax-loss harvesting limitations may include the limit on how many capital losses can be used in a year to offset capital gains for both short- and long-term losses. If your losses completely.

Whenever total capital gains and losses for the year add up to a negative number a net capital loss is incurred. There is no limit to the amount of investment gains that can be offset with tax-loss harvesting. Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

If she deployed the same tax loss harvesting strategy she would have reduced her capital gains tax liability from 300 to 75 a reduction of 60. Example of a Crypto Tax Loss Harvesting Scenario. Contact a Fidelity Advisor.

Tax-loss harvesting is the timely selling of securities at a loss in order to offset the amount of capital gains tax due on the sale of other securities at a profit. Two years later you sell the 2 BTC for 8000. To tax-loss harvest Mary would sell that fund thereby recognizing a 7000 capital loss.

As mentioned above theres a limit to how much you can reduce your ordinary income each year through tax-loss harvesting. Contact a Fidelity Advisor. Limit capital gains for your clients Help your clients offset short-and long-term capital gains with automatic tax-loss harvesting of client accounts.

When an investment declines in value. The current tax rules allow you to use capital. Even if you cant claim the maximum 3000 net loss you can still reduce the value of your gains and save on taxes that way.

If the net capital loss is less than or equal. When to Implement Tax-Loss Harvesting. The upside of losing is limited to 1500 to 3000 a year.

However Internal Revenue Service IRS rules allow. Measure your year-to-date gains and losses now so. 3000 per year for individual filers or married.

Online Assist add-on gets you on-demand tax help. Tax loss harvesting involves selling a losing investment in order to generate capital losses that you can write off on your tax return. Investors are allowed to claim only a limited amount of.

Tax Loss Harvesting And Wash Sale Rules

Rate Moves Provide Big Fixed Income Tax Loss Harvesting Opportunities

Reap The Benefits Of Tax Loss Harvesting

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Tax Loss Harvesting And Tax Gain Harvesting Step By Step

Turning Losses Into Tax Advantages

Tax Loss Harvesting Everything You Should Know

Tax Loss Harvesting Definition Example How It Works

Tax Loss Harvesting Partners Physician Finance Basics

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

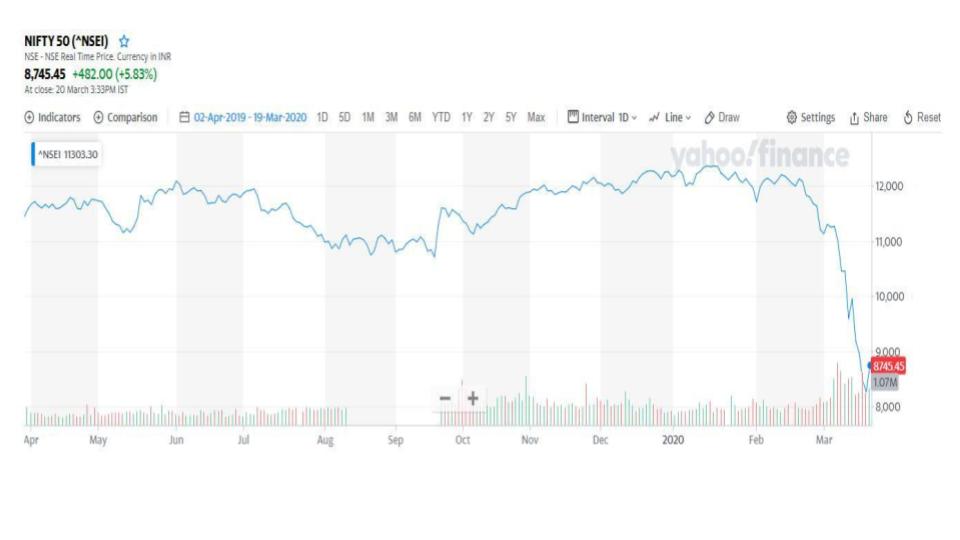

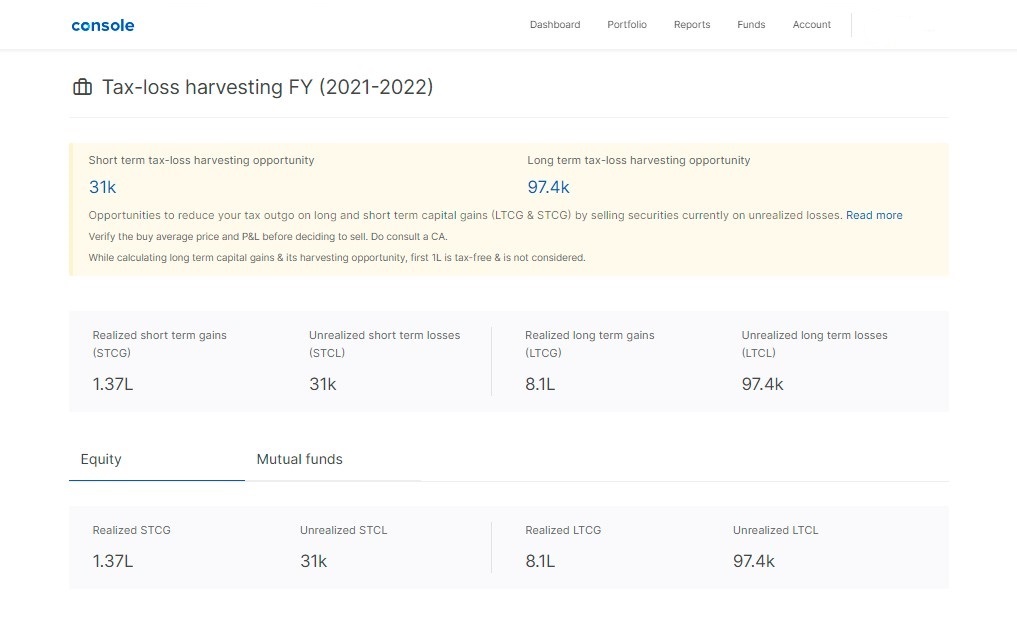

Tax Loss Harvesting Opportunity For Fiscal Year Fy 2021 22 Z Connect By Zerodha Z Connect By Zerodha

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

Tax Loss Harvesting And Tax Gain Harvesting Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Turning Losses Into Tax Advantages

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Tax Loss Harvesting Example Of Tax Loss Harvesting How Does It Work

.png)

The Complete Guide To Crypto Tax Loss Harvesting

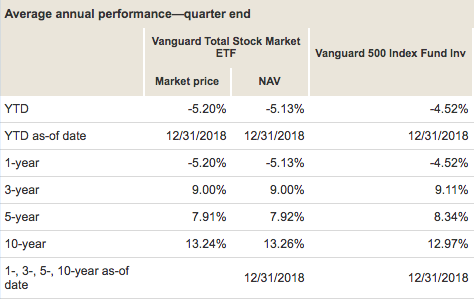

How To Tax Loss Harvest At Vanguard With Screenshots White Coat Investor